ETH Price Prediction: Will ETH Hit 4000 Amid Bullish Signals?

#ETH

- Technical Strength: ETH trades above its 20-day MA with narrowing MACD bearishness.

- Institutional Demand: BlackRock and Ark Invest activities signal confidence.

- Regulatory Risks: DOJ probes may cause short-term fluctuations but unlikely to derail bullish trend.

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

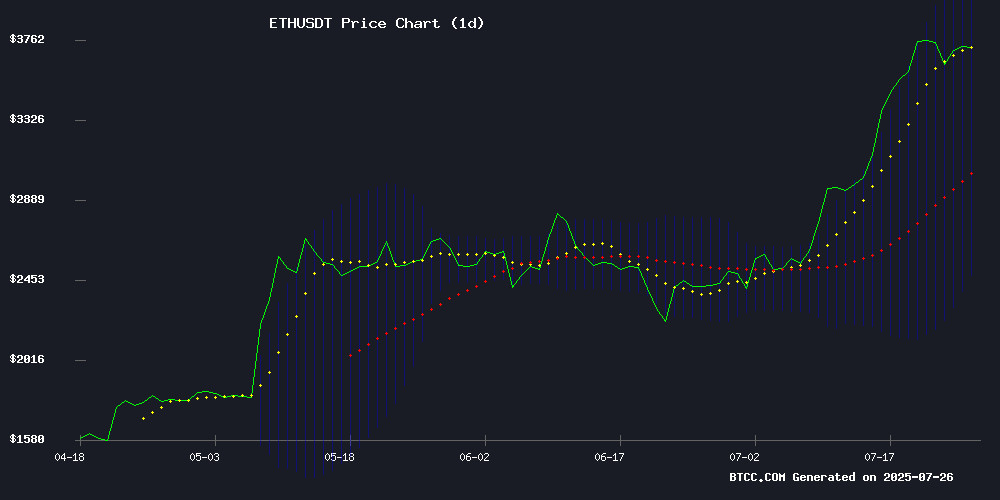

According to BTCC financial analyst Mia, ETH is currently trading at 3740.74 USDT, above its 20-day moving average (MA) of 3297.7960, indicating a bullish trend. The MACD (12,26,9) shows a narrowing bearish momentum at -51.2567, while the Bollinger Bands suggest potential volatility with the upper band at 4117.4196 and the lower band at 2478.1724. These technical indicators point to a possible upward movement towards the 4000 USDT mark.

Institutional Interest and Market Sentiment Boost ETH

BTCC financial analyst Mia highlights that Ethereum's recent surge has attracted institutional interest, as seen with BlackRock's accumulation and Ark Invest's portfolio adjustments. However, regulatory probes like the DOJ's Tornado Cash case may introduce short-term volatility. Overall, the news sentiment aligns with the technical outlook, reinforcing bullish momentum for ETH.

Factors Influencing ETH’s Price

Ethereum’s Meteoric Rise Sparks Institutional Interest

Ethereum has surged over 50% in the past month, with institutional demand driving its price upward. Bitwise’s Matt Hougan attributes this growth to the launch of Ethereum-based ETFs and corporate treasury acquisitions. Since mid-May, over $5 billion has flowed into spot Ethereum ETFs, while companies like Bitmine and SharpLink have publicly disclosed Ethereum-focused reserves.

Hougan notes that ETFs and corporate treasuries have purchased 2.83 million ETH since May 15, exceeding $10 billion at current prices. These purchases outpaced new supply by 32 times, creating a supply-demand imbalance that explains Ethereum’s price appreciation. The trend is expected to continue in the coming months.

SharpLink Gaming Stock Drops 5% Despite Ethereum-Focused Strategy and BlackRock Executive Appointment

SharpLink Gaming, Inc. (SBET) experienced a volatile trading session on July 25, 2025, with shares initially surging before reversing to close 5.87% lower at $21.95. The midday pullback occurred despite the company's announcement of a major leadership change and reinforced commitment to Ethereum-based initiatives.

Joseph Chalom, former Head of Digital Assets Strategy at BlackRock, was named co-CEO effective immediately. Chalom brings two decades of institutional finance experience, including key roles in launching BlackRock's IBIT ($87B AUM), ETHA ($10B AUM), and BUIDL - the first tokenized Treasury fund on Ethereum. His appointment signals SharpLink's strategic pivot toward Ethereum ecosystem development.

Market reaction appeared divided, with heavy trading volume reflecting both optimism about Chalom's crypto credentials and concerns about execution risk. The stock's failure to maintain morning gains suggests investors may be taking a wait-and-see approach to SharpLink's Ethereum ambitions despite the high-profile hire.

DOJ Expands Tornado Cash Probe to Dragonfly Executives in KYC Evasion Case

Federal prosecutors are considering new charges against executives at crypto venture firm Dragonfly as the Tornado Cash trial intensifies. The Department of Justice is scrutinizing internal communications between Dragonfly personnel and developers of the privacy-focused protocol, with a focus on early discussions about Know-Your-Customer compliance.

Emails presented as evidence reveal Dragonfly's financial backing of Tornado Cash during its formative stages. Assistant U.S. Attorney Rehn confirmed the potential for expanded charges in court, specifically mentioning Dragonfly General Partner Tom Schmidt before requesting portions of the proceeding be sealed.

The case highlights growing regulatory scrutiny of cryptocurrency privacy tools and their institutional connections. Market observers note the proceedings could establish important precedents for venture capital liability in decentralized finance projects.

WeWake Presale Launches Amid BlackRock's Ethereum Accumulation

The cryptocurrency market is witnessing a shift from speculative trading to practical utility, with WeWake Finance's presale marking a significant milestone. The project's Layer 2 blockchain eliminates traditional barriers like wallet management and gas fees, offering Web3 access through social logins. This approach targets mainstream adoption by simplifying interactions with NFTs, DeFi, and token swaps.

Institutional confidence grows as BlackRock substantially increases its Ethereum holdings, signaling long-term belief in ETH-powered infrastructure. The simultaneous emergence of user-friendly solutions like WeWake and institutional bets on core blockchain networks suggests a maturation phase for crypto adoption.

Ark Invest Rebalances Portfolio with $22M Sale of Coinbase, Block Shares

Ark Invest has executed a strategic rebalance of its crypto-focused ETFs, divesting over $22 million in shares across Coinbase Global, Block Inc., and Robinhood Markets. The firm's ARK Innovation ETF (ARKK) and ARK Next Generation Internet ETF (ARKW) collectively sold $12.1 million worth of Coinbase stock at $396.70 per share, while trimming positions in Block ($9.8M) and Robinhood ($1.1M).

The moves coincide with a 0.28% dip in Coinbase shares and marginal declines for Block and Robinhood. This follows Ark's recent $182 million investment in Bitmine—a digital asset newcomer reporting over $1 billion in Ethereum holdings—signaling a broader institutional pivot toward emerging crypto opportunities.

Crypto Whale Spends $4.3M on CryptoPunks Amid NFT Market Resurgence

A single buyer dropped $2.9 million on six rare CryptoPunks featuring the coveted hoodie trait, signaling renewed vigor in the NFT market. The purchases, executed swiftly on OpenSea, followed a broad-based surge in floor prices for top collections.

CryptoPunks climbed 29% to nearly 51 ETH ($190,000) over 30 days, while Pudgy Penguins and Bored Ape Yacht Club saw gains of 66.7% and 9.8%, respectively. The hoodie acquisition stands out—the buyer now holds 12 of these digital assets.

The NFT market cap jumped 66% to $6 billion during the period, with CryptoPunks claiming over 30% dominance. Yet the sector remains a shadow of its 2021-2022 peak when valuations hit $16.6 billion—before major marketplaces shuttered or pivoted to token trading.

GameSquare Acquires CryptoPunk NFT for $5.15M and Bolsters ETH Treasury

Digital media firm GameSquare has made a strategic investment by purchasing Cowboy APE #5577 from the CryptoPunks NFT collection for $5.15 million. The Frisco-based company also added $10 million worth of ether to its treasury, bringing its total ETH holdings to 12,913.49 coins valued at approximately $48.5 million.

The transaction involved preferred stock as payment to Robert Leshner, founder of Compound Labs. CryptoPunks, created in 2017, remain foundational to the NFT movement, influencing digital ownership standards on blockchain networks.

GameSquare plans to leverage its CryptoPunk acquisition for marketing campaigns, community engagement, and potential licensing deals. The move aligns with growing corporate interest in ether treasury strategies, particularly among media and gaming companies seeking Web3 integration.

SharpLink Gaming currently leads corporate ETH holdings with over 360,000 coins, as more firms explore staking for passive yield generation. The Ethereum ecosystem continues attracting institutional investment through both digital art and cryptocurrency allocations.

Will ETH Price Hit 4000?

Based on technical and fundamental analysis, ETH has a strong chance of reaching 4000 USDT. Key factors include:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | 3740.74 USDT | Near resistance at 4000 |

| 20-Day MA | 3297.7960 | Supports uptrend |

| MACD | -51.2567 | Bearish momentum fading |

| Bollinger Bands | 4117.4196 (Upper) | Volatility expected |

Institutional demand and positive sentiment further bolster this outlook.